Investment Avenues

Diverse Investment Avenues 2023: Wall Street, Survivor & Church Finances

Explore diverse investment avenues for Wall Street success, survivor financial empowerment, and effective church stewardship. Expert advice for all.

Exploring Investment Opportunities Beyond the Ordinary

Investing is like embarking on a journey. Your path can lead to various destinations with unique opportunities and challenges. From the bustling streets of Wall Street to the financial strategies for survivors and the responsible stewardship of church finances, this article is your guide to navigating diverse investment avenues.

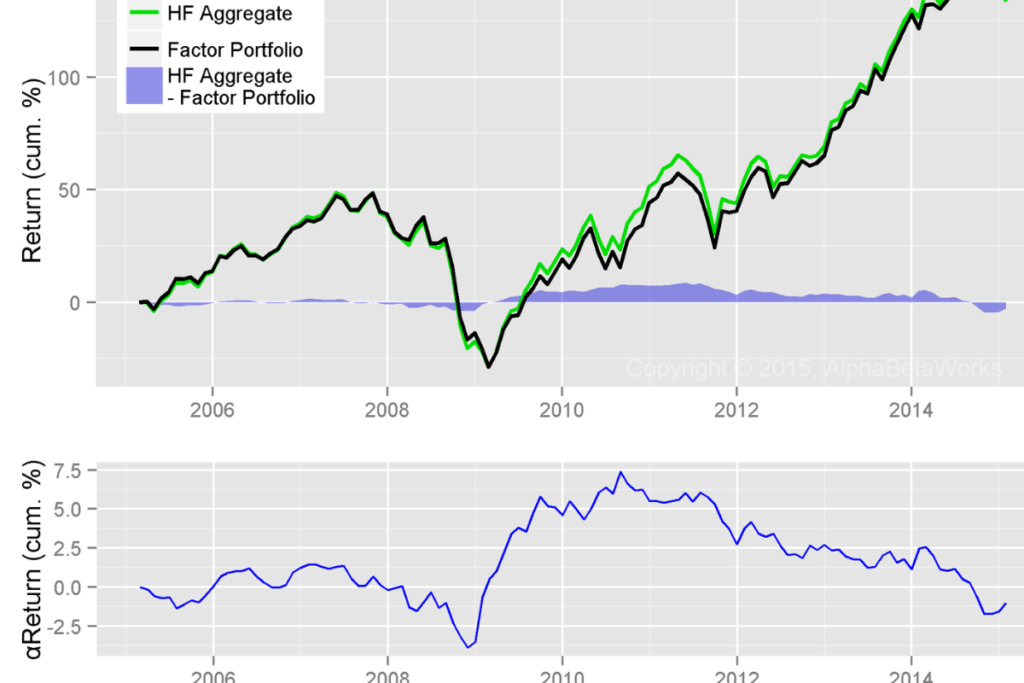

Navigating Wall Street: Unveiling Opportunities Beyond the Surface

Wall Street has long been synonymous with high-stakes trading, intricate financial instruments, and bustling trading floors. However, beneath the surface of this financial epicenter lies a world of potential that extends beyond the stock market alone.

Embracing Diversity: Beyond Stocks and Bonds

While stocks and bonds are the bread and butter of many investment portfolios, Wall Street offers many alternative investment avenues. Diversification is critical for real estate investment trusts (REITs) that provide a share in actual property holdings to commodities like gold and oil. These alternative investment avenues often move independently of the stock market, adding an extra layer of security to your portfolio.

The Rise of ESG Investing

Environmental, Social, and Governance (ESG) investing has gained significant traction in recent years. Investors are now considering the impact of their investments on the world. Companies focused on sustainable practices, social responsibility, and ethical governance are becoming more attractive to conscientious investors. This shift in perspective aligns with positive change and presents an opportunity for potentially lucrative returns.

Technology and Innovation: Riding the New Wave

The technological revolution is reshaping industries at an unprecedented pace. Wall Street recognizes this and offers avenues to invest in innovative companies at the forefront of technological advancements. Investing in these sectors can be financially rewarding and intellectually stimulating, from artificial intelligence and biotech to renewable energy.

Financial Resilience: Strategies for Survivors

Life can throw unexpected challenges, and financial preparedness is essential for survivors. Whether you’re overcoming a personal loss or a global crisis, these strategies can help you navigate the storm and secure your financial well-being.

Building an Emergency Fund

An emergency fund is your safety net in times of crisis. Aim to save at least six months’ living expenses in a separate, easily accessible account. This fund provides peace of mind and ensures unexpected events won’t derail your financial stability.

Conservative Investment Approaches

During times of uncertainty, a conservative investment approach can provide stability. Focus on low-risk investments, such as government bonds or dividend-paying stocks. While the potential returns might be lower, the reduced risk can help weather the storm more effectively.

Continuous Learning and Skill Development

Investing in yourself is just as important as investment avenues in financial assets. Acquiring new skills and knowledge can enhance your employability and open up new opportunities for income generation. Consider online courses, workshops, or vocational training to stay competitive in the ever-evolving job market.

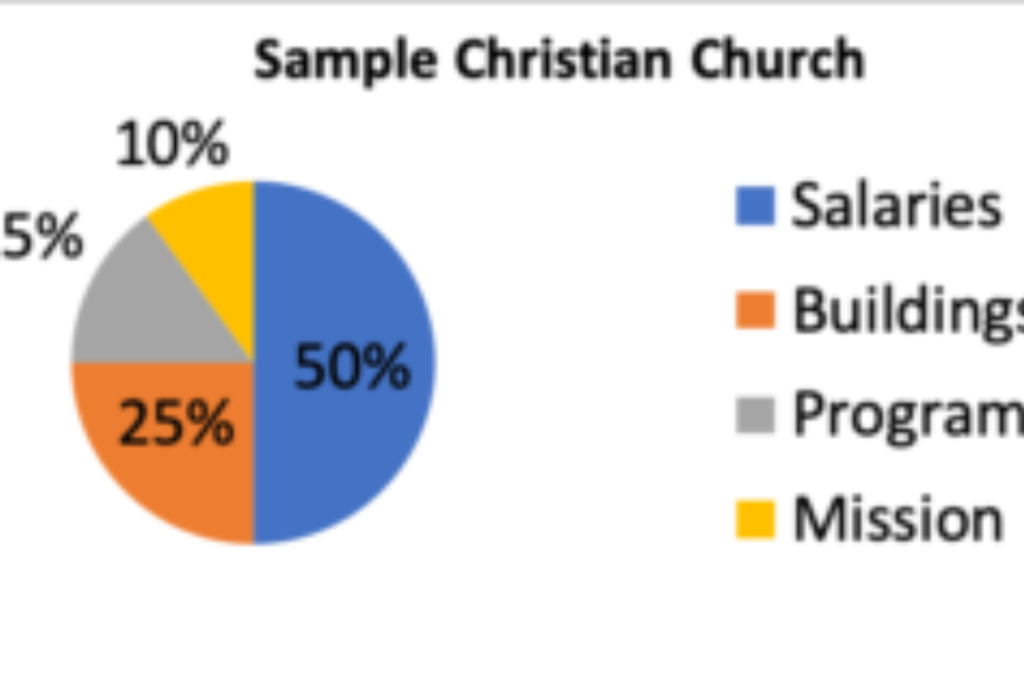

Responsible Financial Stewardship: Nurturing Church Finances

Churches play a vital role in communities, and responsible financial stewardship is crucial to support their missions effectively. Whether you’re a member of a congregation or part of a leadership team, these principles can guide you in managing church finances.

Transparency and Accountability

Maintaining transparent financial practices builds trust within the congregation. Regularly communicate the church’s financial status, budgets, and spending to ensure everyone is informed and create investment avenues .To Play Exciting Game Visit Here

Establishing a Reserve Fund

Similar to personal emergency funds, churches should have reserve funds to address unforeseen expenses or periods of reduced income. This financial cushion provides stability during challenging times and prevents hasty financial decisions.

Ethical Investments in Alignment with Values

As individuals explore ESG investing, churches can also align their investment avenues with their values. Invest in companies that adhere to ethical practices and contribute positively to society, reflecting the church’s mission and beliefs.

Conclusion

In the world of finance, there’s no one-size-fits-all approach. The key is adaptability, from Wall Street’s diverse investment avenues to the strategies that help survivors thrive and the responsible management of church finances. By embracing these unique investment avenues and approaches, you’re safeguarding your financial future and contributing to a more resilient and prosperous community. So, embark on this journey with an open mind, a willingness to learn, and a commitment to making the most of every opportunity.

Remember, the financial landscape is ever-evolving, and being informed is your greatest asset. Whether you’re a seasoned investor, a survivor overcoming challenges, or a steward of church finances, the knowledge and strategies you gain today will shape a brighter and more secure tomorrow.

Areej Fatima

Areej Fatima, an accomplished BSCS scholar, adeptly blends her technical prowess with a passion for creative expression. Rooted in a strong foundation of computer science, she weaves captivating content that bridges the gap between innovation and artistry. Areej has diligently honed her writing skills over the past six months. Her unique ability to harmonize technology and storytelling sets her apart as a versatile and promising writer.

-

Visa Guide2 years ago

Visa Guide2 years agoCan Freelancers Get Canadian Immigration? Guide for Aspirant 2023

-

Freelancing2 years ago

Freelancing2 years agoFreelancer as a Student: Be Your Own Boss in 2023

-

Freelancing2 years ago

Freelancing2 years agoFreelancing as a Career: Scope for Pakistani Students 2023

-

Business Networking1 year ago

Business Networking1 year agoMastering the Art of Freelance Guest Blogger in 2023

-

Freelancing2 years ago

Freelancing2 years agoBest Bank for Freelancers in Pakistan – Mastering Your Money

-

Money Management2 years ago

Money Management2 years agoEmbracing BRICS Currency: Financial Advice for Freelancers

-

Visa Guide2 years ago

Visa Guide2 years agoFreelancing for UK Immigration 2023 – Your Ticket to Success

-

Visa Guide2 years ago

Visa Guide2 years agoFreelancing on an F1 Visa: Maximizing the Opportunities